Corporate Transparency Act

CTA Reporting

❗The US Treasury recently announced overhauling FinCEN Beneficial Owner Reporting (BOIR) to exclude domestic reporting companies like condos, co-ops and HOAs.

Why NOW?

Initial Beneficial Ownership Information Reporting (BOIR) for pre-existing organizations is due by January 1, 2025.

Why SMAARTE?

Many community association management companies are charging up to $500 to file a report that takes 15 minutes or less. 🤬

We’re making your initial Corporate Transparency Act (CTA) Beneficial Ownership Information Report (BOIR) FREE and EASY.

Corporate Transparency Reporting from the SMAARTE Group delivers:

One FREE, initial FinCEN BOIR filing with no strings attached. Really!

Guaranteed filing within 5 business days of your submission

A secure process using FinCEN IDs to protect PII

Optional, ongoing reporting for $50 per filing

The SMAARTE Guarantee

Corporate Transparency Reporting is was REQUIRED by Federal Law

Effective January 1, 2024. Read all the details on this page.

Reporting companies created or registered before January 1, 2024, will have one year (until January 1, 2025) to file their initial reports

Reporting companies created or registered after January 1, 2024, will have 30 days after creation or registration to file their initial reports

Once the initial report has been filed, both existing and new reporting companies will have to file updates within 30 days of a change in their BOI

FinCEN is NOT Interested in “Gotcha” Enforcement

BUT your association still needs to report. February 14, 2024: FinCEN Director Testimony to Congress

“I want to clearly state that FinCEN has no interest in hitting small businesses with excessive fines or penalties. The CTA penalizes willful violations of the law, and we are not seeking to take “gotcha” enforcement actions.”

Your Association MUST comply unless:

1. Registered as a 501(c) corporation. Some HOAs hold 501(c)(4) status. View Why Your Association is NOT a 501(c)(3) -OR-

2. It employs 20 or more individuals AND reports over $5,000,000 in gross revenue to the IRS

What Does Reporting Look Like?

-

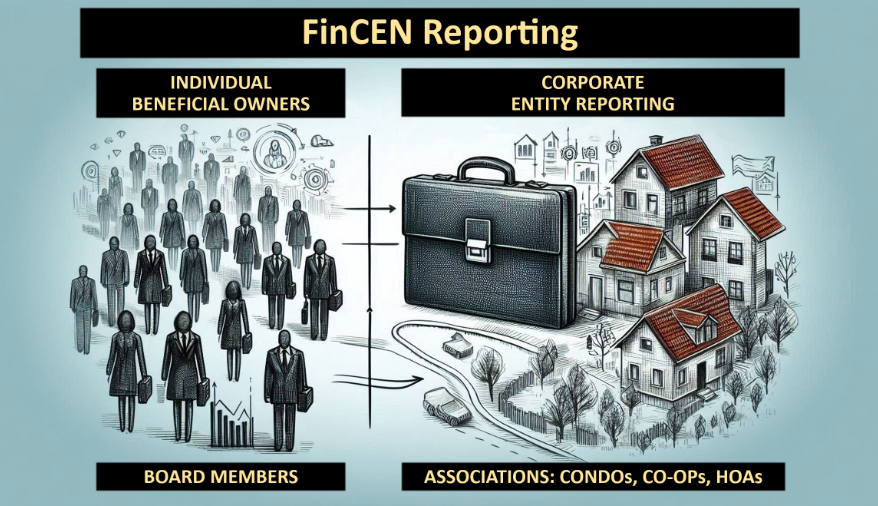

CORPORATE ENTITY REPORTING

1. Business Name and Trade Name(s) and/or DBAs

2. Business Address

3. Formation Jurisdiction

4. IRS Taxpayer ID (EIN) - BENEFICIAL OWNERS REPORTING

1. Name

2. Birthday

3. Address

4. A unique government-issued identifier (passport, driver’s license, etc.)

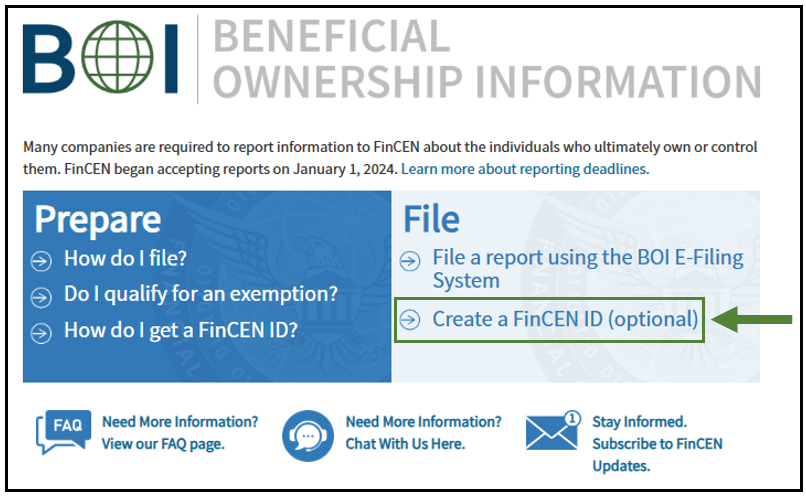

Every beneficial owner (Board member / director) SHOULD create a FinCEN ID to safeguard their sensitive information!

-

INDIVIDUAL: Every director (board member) is a beneficial owner.

-

Every beneficial owner creates a FinCEN ID. This keeps personal information between the INDIVIDUAL and FinCEN (the US federal government).

-

INDIVIDUAL UPDATES only occur if information previously provided changes.

-

CORPORATE: The Association reports its business information (name, address, etc.) and includes the individual FinCEN IDs.

-

CORPORATE UPDATES occur within 30 days of changes to INDIVIDUAL beneficial owners such as when new board members are elected or appointed.